I go into more detail on this in my book, You Can Retire Sooner Than You Think, but just remember: With investing, there are the two prongs of wealth building. Here’s where your retirement savings portfolio comes into play.

#FILL THE GAP PORTFOLIO HOW TO#

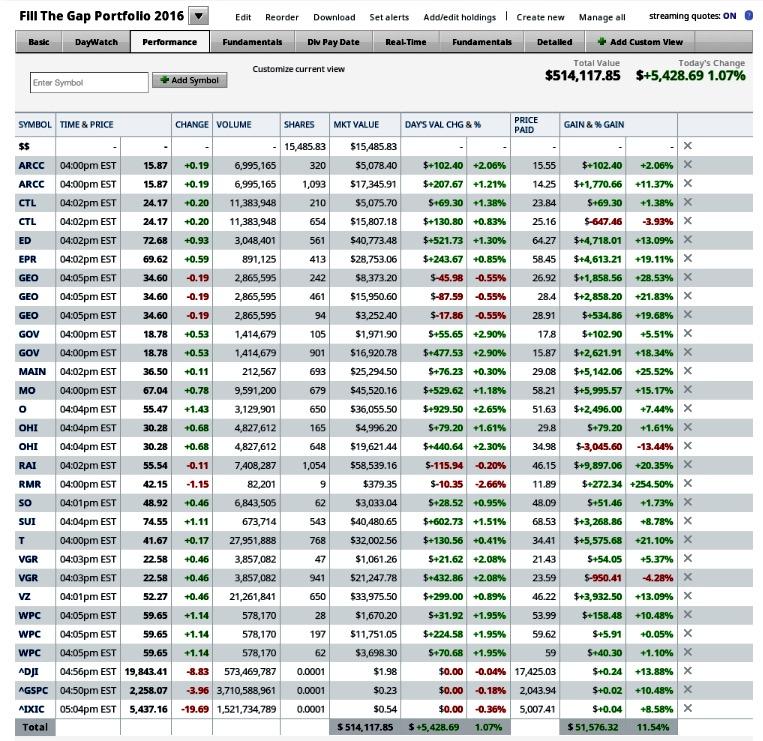

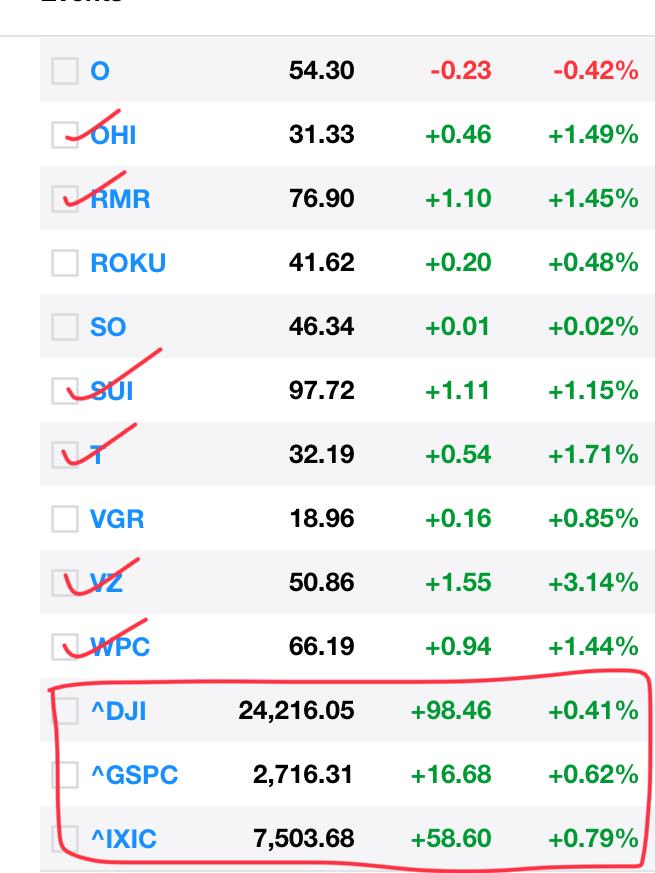

Now that you have a sense of your real-time retirement numbers, it’s time to plan for how to fill the gap. This is the perpetual gap that you’ll need to fill each month.

Say, for example, that your initial retirement income each month will be $3,500. Once you’ve calculated all your expenses, subtract this number from this initial monthly income figure. Next, create a budget of your expenses to determine your monthly spending need. This number is your initial monthly income excluding your investment income from liquid assets (401ks, IRAs, brokerage accounts, etc.). Add all your guaranteed and semi-guaranteed income streams - like pension payouts, Social Security benefits, veteran’s benefits, rental income, and part time work - together. To apply the FTG strategy to your specific financial picture, start by calculating your monthly retirement income. “filling the gap.” The FTG strategy is a specific formula that first identifies your actual needs and lets you work backward from there. So how exactly does the FTG strategy work? In essence, it focuses on covering expenses that your Social Security benefit, pension, and any other income streams won’t cover during retirement, i.e. Using FTG, will show you, on paper, that retirement could be well within reach. Now that we’ve dispensed with Wall Street’s one-size-fits-all, huge nest egg approach to retirement, we can turn to the highly workable, highly individualized FTG strategy. And if you base how much money you need for retirement on Wall Street’s numbers, you may never feel you have enough. Because most of Wall Street is publicly traded, they need an ever increasing stream of investor assets for their share prices to rise. Remember, Wall Street’s viability relies on investors. The same goes for reports issued by Wall Street firms. Clearly, this information benefits their business. As an example, news reports on a Legg Mason survey indicated that investors believe they need $2.5 million in retirement to enjoy their same quality of life. It’s important to consider the source of the information. Using this strategy, you create a financial formula that fits your individual retirement needs.īefore we delve into my FTG approach, let’s run through Wall Street’s recommendations and what’s behind them.

Instead of focusing on hitting an arbitrary big, round number in your investment portfolio, another approach to retirement planning is using my Fill the Gap (FTG) strategy. Sure, it’s great to have a large nest egg for retirement, but that’s not the only road to a happy, financially secure retirement. Like, “Is this an accurate range for everyone?” And, “Is it realistic for most folks to have this level of savings?” My answer to both of these questions is no. Map your unique road to retirementīefore we buy into the scare tactics, we should note that these estimates actually raise more questions than they claim to answer. And big numbers like these can strike fear in the heart of even the most prudent would-be retiree. To hear Wall Street tell it, you need to amass between $1 million and $2.5 million in retirement savings if you want to live comfortably when you quit the 9-to-5.

0 kommentar(er)

0 kommentar(er)